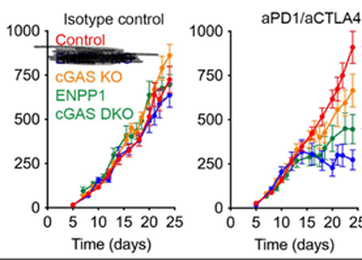

Persistence To start with, you must not get dismayed at the possibility of making dozens, even hundreds, of “pitches” to all sorts of investors and having nothing to show for it. Expect to be laughed at, scorned, hung-up on, and told you’re crazy to try this nonsense. I’ve heard it all before myself and you will too if you persevere. Let’s just start with an oldie, but goodie, quote from President Calvin Coolidge: Nothing in this world can take the place of persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan Press On! has solved and always will solve the problems of the human race. OK, that’s a hundred-year-old quote, but still one of my favorites. If you want something more recent, Howard Schultz of Starbucks started his own coffee business called IL Giornale and tried to raise $1.6 million to get it off the ground. He is living proof that President Coolidge was spot on. From Mr. Schultz’s own words, "In the course of the year I spent trying to raise money, I spoke to 242 people, and 217 of them said no," he wrote. "Try to imagine how disheartening it can be to hear that many times why your idea is not worth investing in. ... It was a very humbling time." I bet it was a humbling time. I wonder how many people told Mr. Schultz something like “But Howard, it’s a friggin coffee shop!” So, ask yourself, are you prepared to hear NO a few hundred times? I doubt it. Mr. Schultz has a spine made of steel. So what happened? In August 1987, IL Giornale bought the small Starbucks business for $3.8 million, and Schultz became CEO of Starbucks Corporation. At the time, there were six stores. Of course, now there are thousands of stores and Mr. Schultz’s net worth is north of $5 billion. I can give you dozens of similar stories about staying the course, and sometimes the results are well worth the aggravation and scorn. If you’re one of those people who are always waiting for just the right time to get started, here’s a beautiful quote for you: “The future has several names. For the weak, it is impossible; for the fainthearted, it is unknown; but for the valiant, it is ideal.” Victor Hugo wrote that almost 200 years ago! Its as true now as it was then. There is no right time to get started! The Mechanics OK, what will an investor want to hear from you? It only takes a few seconds online to pull up thousands of examples, of what are usually called a pitch doc. These are PDFs made from PowerPoint slides that describe the founders, the problem they want to solve, the idea/thing/service to solve it, the opportunity for greatness, and the ask. The best ones are 10 to 12 slides. Yes, just a dozen slides with nice large fonts is all you need. That’s another problem, not being able to distill your concept down into a few short sentences on just a few pages. I know its hard, but that’s what the investor wants to see. Remember, they usually see several pitches a week and don’t have time to read your novel. Sounds simple enough. But you will not believe what I get to read over the course of a month. I think the worst ones are written by the smartest people in the room. The PhD types, describing their invention or drug or whatever written to an audience of other PhD's. Let me tell you, most investors are plenty intelligent, and a few might have a PhD, but most of us will not follow along when the pitch has sentences such as, “DENDRITIC CELL DEPENDENT ENHANCEMENT OF NK AND CAR-T CELL ACTIVITY BY XXPP1 INHIBITORS”. Scientists generally don’t write very well for non-scientists to understand. But the audience for the pitch is just regular people who want to invest in new and exciting products (or services). Here's another example. I blacked out the name of the product (at least I think it was the product, not too sure), but can you tell me anything from the charts? Only that it gets higher over time. None of those acronyms are defined and I don’t know if it’s a good thing or a bad thing that the lines rise! They never say. If you are creating the pitch doc, you absolutely need to ask several other people to review it before you send it to an investor. And ask them tear it to shreds. You’ll be much happier down the road when the money comes in instead of the “no” word. The Entrepreneur What does the investor want to see or hear about you, the entrepreneur? Several things, starting with your specific knowledge about the product or service. Have you ever worked with this before? What happened? Have you ever received any patents or trademarks about the concept or product? What is your specific experience in this area? Have you ever started any other businesses before, either in this field or otherwise? What happened? What about your knowledge of how to market this thing? If you can’t market it, you’ll lose all of the investor’s money and likely all of yours as well. How much have you personally put into the business? You must realize that you’ll be asked for bank records, copies of your personal checks, a full accounting of the spend and income over the life of the business. Yes, you will have to provide all of that – it helps us weed out the thieves, crooks, and assorted nitwits who try and get our money by lying. And don’t forget personal and business references, all the incorporation paperwork, a list of clients, customers, advisors, board members, and employees. Don’t forget the accountant and attorney’s engagement letters. They show you’ve at least retained a minimum of support. The Offer If you get an offer, you can accept or reject it outright, or you can counter, or change your ask, or you can provisionally accept it (depending on some subsequent event like a large client coming on), whatever you can think of to make it acceptable to you. Remember it isn’t carved in stone! You don’t have to accept it all if its really too far. Be aware, some investors, such as myself, will make a multi tier offer. For example, I might offer you $25,000 now, and another $25,000 if you can hit a certain sales dollar volume in three or six months. That will show me something very important – there’s a market for what you have going. Or to say it like me, the “market” has to speak. If you can’t sell it, then it’s not worth a dime. The offer might be for some type of loan. Typically, those are called a convertible note. It has an interest rate, always differed to later, a time limit, and the terms of the conversion. In other words, the loan will turn into shares, maybe preferred, maybe common, at some future date. The differed interest is also converted into shares as well. Plus, if the share price can be determined, the early investor will get a discount when purchasing the shares. So, if the shares are legitimately priced at $10 bucks, and the convertible note carries a 20% discount (that’s the most common number), the share value that the note will be able to purchase shares is $8. A built-in discount! Might not be able to sell them right away, but he gets to “buy low and (hopefully) sell higher” later. Plus, there’s another important item here. It’s called a “cap” and imagine the company is growing like crazy, and when the convertible note is due, the company is worth $25 million dollars! Sounds great but your early investment won’t have much of the business, will it? Nope. So most convertible notes have a cap, say $2 million. If you put in $25,000 at a $2 million cap you’ll own 1.25% of the shares (I’m ignoring the additional impact of the differed interest). That’s great if the business is worth the $25 million! Some creative investors, such as myself, will combine the terms of multiple offers. In other words, I might offer money right now for actual shares. Then I’ll also want something called warrants to exercise later. A discussion of warrants is beyond this article so I will refer you to my website, https://tidewaterservices.net/angel.html for a white paper containing everything you need to know about warrants. (Scroll down on the page to find it.) In a nutshell, a warrant is a contract that allows me to purchase shares in the future – but we decide on that future price today. I also have to pay for that contract now. In other words, I buy warrants, usually pennies for each share if the business is really new, bu maybe a few dollars if the business has been around a while, and then if the business takes off in a couple of years, I’ll “exercise” the warrant contract to purchase actual shares, preferred or common as described in the warrant, for a price that we decide on now. For example, the warrant contract price might be a dollar for each share. If you get a future investment round and those investors see your company valued at, say $5 dollars a share, I can exercise my warrants and buy the shares from you for a dollar! I might not be able to sell them right away, but I’ll have a great deal in front of me. Usually, the entrepreneur offers warrants to the early investors as a prize or sweetener for an early investment. The investor typically makes an investment now, maybe a convertible note or even a direct share purchase, and holds the warrants so that down the road he might have a nice reward for the early investment. Sometimes the business falters or fails outright, and those wonderful warrants are then worthless. That’s the risk the investor takes. You win some, you lose some. The Product For me, before I’ll make an offer, the number one issue is, will the market buy the product/service? I’ve tried guessing before on products and have lost everything when there was no market. Or as I like to say, I need to hear the market speak. So obviously if you have actual paying customers that are buying your thing, that gets me excited. Now I have something to work with. Otherwise, I probably won’t be very interested unless it’s some crazy new idea that is obvious in its application. Another thing I’ll look for is a pivot. It’s very rare that an idea is so good that it works from the concept stage right into production. I mean VERY rare. This shows me something not about the idea, all ideas change over time, but something about the entrepreneur. Are they open to pivoting when the market says you have to, or do they just keep struggling? The Bottom Line

So, stay the course (but be ready to pivot when necessary), keep the pitch doc really simple, get familiar with the various types of investments you will likely encounter, and sell, sell, sell. Maybe you’ve heard this before, but sales solves (almost) every problem! Good luck! P.S. If you have a business that fulfills the above concepts, reach out using our Contacts page and I’ll look it over.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorMy name is Lee West. I help people develop their businesses into industry leaders so they can achieve their dreams. Thank you for reading. Archives |

RSS Feed

RSS Feed